GST Compliance in 2025: Key Changes and Best Practices

Theodore Lumpkin

Tax Associate

The Finance Act 2025 introduces significant amendments to the Goods and Services Tax (GST) Act 2009, focusing on compliance requirements such as the deadline for GST filing, required documentation, penalties for non-compliance, and payment obligations for relieved persons and organisations. This blog examines the revised compliance framework, key amendments, and practical steps for taxpayers in Sierra Leone to align with the updated GST regulations, which took effect on January 1, 2025.

Significant Changes in the GST Filing Deadline and the Required Schedules

Before the Finance Act 2025, taxpayers were required to file GST returns by the end of the following month, submitting total taxable sales and purchases along with an input tax schedule. According to Section 13 of the Finance Act 2025, amending Section 37 of the Goods and Services Act 2009, the deadline for submitting GST returns has been moved to the 21st of the following month, requiring taxpayers to submit their total taxable sales and purchases with mandatory detailed sales and purchase schedules. However, the deadline for GST payments remains unchanged at the end of the following month. Taxpayers must adhere to the amended deadline and mandatory sales and purchase schedules to avoid penalties from the National Revenue Authority (NRA).

Introduction of a Structured Penalty Framework for Non-Compliance of Goods and Services Tax (GST) Filing

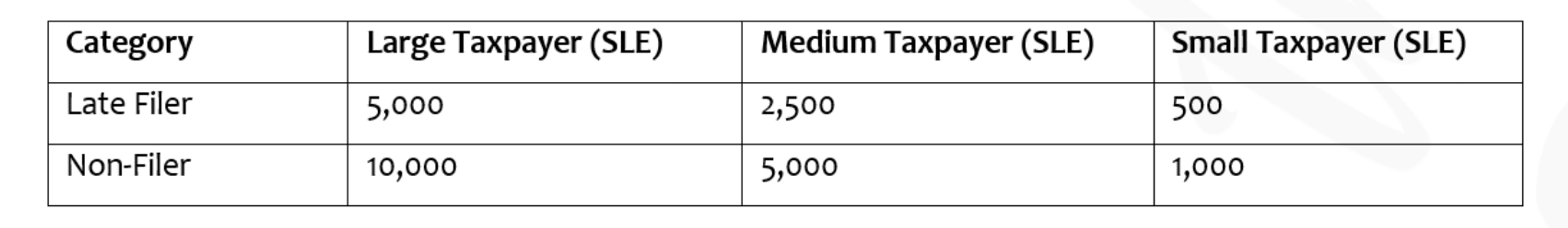

The Finance Act 2025 introduced a structured GST penalty framework for late and non-filers, categorising taxpayers into large, medium, and small classifications. A late filer is a taxpayer who submits their return within 30 days after the due date, while a non-filer submits their return after 30 days of the deadline, as stated in Section 13 of the Finance Act 2022.

The GST penalties are structured as follows:

GST Relief for Exempt Organizations

The Finance Act 2025 grants GST relief to individuals and organisations, such as diplomatic bodies and companies with ratified Parliamentary agreements. These entities are no longer required to pay GST at the point of purchase, eliminating the previous requirement established by the Finance Act 2020, which mandated payment upfront with subsequent refund claims.

Best Practice for Compliance with the GST Amendments in Finance Act 2025

To comply with GST obligations according to the amendments in the Finance Act 2025, taxpayers should adhere to these practices:

File and Pay GST by the Amended Deadline

Registered GST businesses should submit their monthly GST returns through the Integrated Tax Administration System (ITAS) by the 21st of the following month. GST payment must be made at the end of the following month. The deadline has not changed.

Provide Detailed Sales and Purchase Schedules

To ensure compliance with GST regulations, taxpayers must submit a detailed schedule of taxable sales recorded through the Electronic Cash Register (ECR). A comprehensive purchase schedule must also be submitted detailing each transaction's date, vendor name, description, and amount. The Taxpayer Identification Number (TIN) must be included on every purchase invoice to facilitate GST claims.

Ensure Proper Documentation for GST Exemptions

GST-registered businesses must ensure that any relieved organisations eligible for GST exemption should provide a ratified GST exemption agreement from parliament before granting GST exemption.

Filing Relieved GST Transaction

Taxpayers are advised to record transactions with relief organisations or companies in the relieved supplies box when filing through the Integrated Tax Administration System (ITAS) portal. The exclusive Goods and Services Tax (GST) amount should be entered.

Conclusion

The Finance Act 2025 introduces significant amendments to the Goods and Services Tax (GST) framework, effective January 1, 2025. Key changes include an amended GST filing deadline, now set for the 21st of the following month, and the requirement for comprehensive sales and purchase schedules. A structured penalty system has been established to address late or non-filing, with specific penalties based on taxpayer classifications. Additionally, relief organisations, such as diplomatic missions and organisations with ratified parliamentary agreements, are exempt from GST at purchase. It is advised that taxpayers must comply with these GST changes to ensure compliance with the National Revenue Authority (NRA).

You may also like...